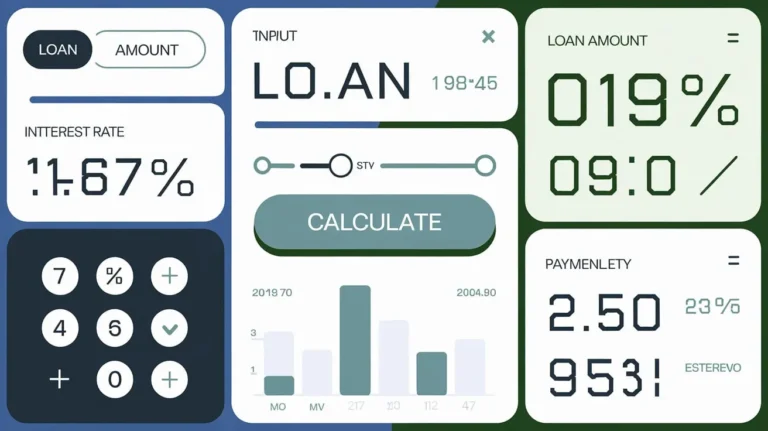

Debt Settlement photo | leadbuyerhub.com

In the world of small business, unpaid debts can pose a serious threat to cash flow and overall financial health.

To help business owners tackle the complexities of debt collection, here are six crucial steps for recovering outstanding debts effectively.

1. Develop a Clear Payment Policy

Establishing a comprehensive payment policy is essential for setting clear expectations with clients.

This policy should detail payment terms, including due dates, late fees, and potential consequences for non-payment.

By embedding these terms into contracts and invoices, businesses can discourage late payments and streamline the debt collection process.

2. Monitor Payments Diligently

Vigilance over accounts receivable is key.

Business owners should closely track payment due dates and promptly follow up on overdue accounts.

Experts suggest reaching out within the first 45 days of a missed payment to enhance the likelihood of recovery.

3. Communicate Professionally

Maintaining a professional tone when contacting debtors is crucial.

A courteous yet assertive approach can facilitate open dialogue, helping business owners understand the reasons for delays.

Effective communication often leads to amicable resolutions without escalating the situation.

4. Send a Formal Demand Letter

When initial attempts to recover the debt fail, issuing a formal demand letter becomes necessary.

This letter should clearly outline the amount owed, the payment deadline, and potential repercussions for non-payment, such as late fees or legal action.

A well-articulated demand letter serves as a formal notice and can prompt action from the debtor.

5. Offer Flexible Payment Options

For debtors facing financial hardship, offering flexible payment plans can be advantageous.

Allowing customers to pay in installments may improve the chances of debt recovery while preserving the business relationship.

6. Escalate to Collections or Legal Action

If all other methods prove ineffective, engaging a debt collection agency or pursuing legal action might be required.

Professional debt collectors possess the expertise and resources to recover debts efficiently.

However, this should be considered a last resort due to potential strain on customer relationships and additional costs.

By adopting these six strategies, small business owners can enhance their debt recovery efforts and bolster their financial stability.

Timely action and professionalism throughout the debt collection process can lead to more successful outcomes and improved financial health.