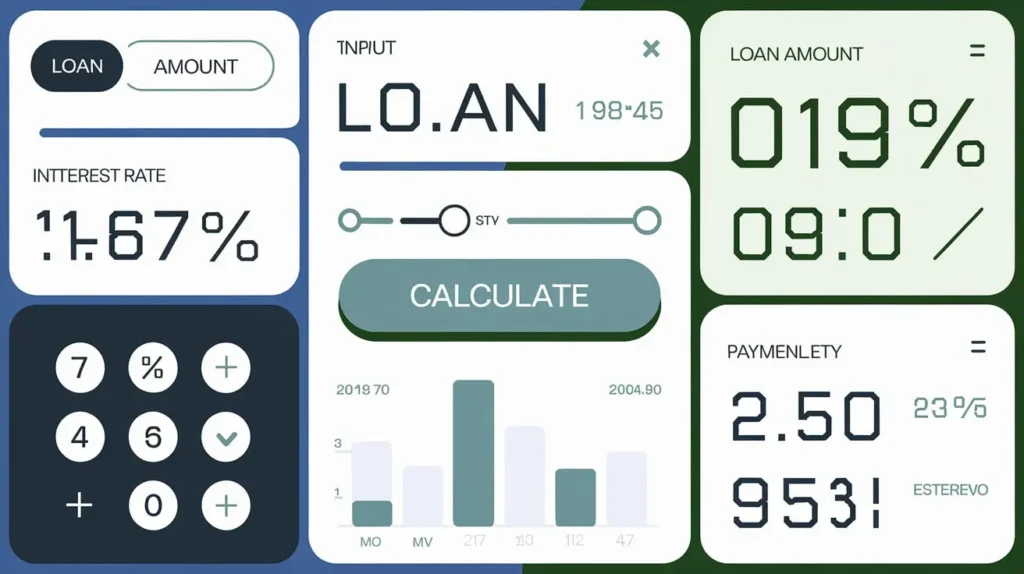

Loan Calculator

Results

Monthly Payment (Principal & Interest): $

Monthly Property Tax: $

Monthly Insurance: $

Total Monthly Payment: $

Understanding Loan Calculations

What is a Loan Calculator?

A loan calculator is a financial tool designed to help borrowers estimate their monthly payments, total interest costs, and overall affordability for different loan scenarios. By inputting key parameters such as loan amount, interest rate, and loan term, users can gain valuable insights into their repayment journey.

See also our PAYE Tax Calculator.

Benefits of Using a Loan Calculator

- Clarity on Repayment: Loan calculators break down your repayment schedule, showing how much you’ll pay each month. This transparency helps you plan your budget effectively.

- Comparison Across Loans: Easily compare different loan options (e.g., fixed-rate vs. adjustable-rate mortgages) to understand their long-term costs.

- Early Repayment Strategies: Experiment with different prepayment amounts to see how they impact your loan term and interest savings.

- Understanding Amortization: Learn how your principal balance decreases over time due to amortization, which can inform your financial planning.

Key Inputs for Loan Calculators

- Loan Amount: The initial sum you are borrowing.

- Interest Rate: The annual interest rate expressed as a percentage.

- Loan Term: The duration of the loan (e.g., 15 years, 30 years).

- Additional Costs: Any fees (origination fees, closing costs) that affect the total loan amount.

How to Use a Loan Calculator

- Input Your Loan Details: Enter the required information such as loan amount, interest rate, and loan term into the designated fields.

- Calculate Your Monthly Payments: Click the calculate button to obtain your monthly payment amount based on the provided data.

- Explore Different Scenarios: Adjust the loan amount, interest rate, or loan term to see how these changes affect your monthly payments.

- Analyze the Amortization Schedule: Review how your monthly payments are allocated towards principal and interest over time.

Example Calculation

For instance, if you take out a $10,000 loan at an annual interest rate of 6% for a term of 4 years (48 months), using a loan calculator can quickly show you that your monthly payment would be approximately $250. This allows you to budget effectively and understand the total cost of borrowing.

Additional Resources

- Amortization Schedule: Generate an amortization schedule to visualize how much of each payment goes toward principal versus interest over the life of the loan.

- Loan Types: Understand different types of loans such as personal loans, auto loans, mortgages, and student loans, and how each type may affect your financial situation.

Frequently Asked Questions (FAQ) About Loans

1. What is a loan?

A loan is a sum of money borrowed from a lender that is expected to be paid back with interest over a specified period. Loans can be used for various purposes, including personal expenses, home purchases, or business investments.

2. What types of loans are available?

There are several types of loans, including:

- Personal Loans: Unsecured loans for personal use.

- Mortgage Loans: Secured loans specifically for purchasing real estate.

- Auto Loans: Loans for purchasing vehicles.

- Student Loans: Loans designed to cover educational expenses.

- Business Loans: Financing options for business needs.

3. How do I qualify for a loan?

To qualify for a loan, lenders typically assess your credit score, income, debt-to-income ratio, and employment history. Each lender may have different criteria, so it’s essential to check with them directly.

4. What is a credit score, and why is it important?

A credit score is a numerical representation of your creditworthiness, based on your credit history. It influences your ability to obtain loans and the interest rates you will be offered. Higher scores generally lead to better loan terms.

5. Can I pay off my loan early?

Yes, many lenders allow early repayment of loans; however, some may charge an early repayment fee. It’s advisable to check your loan agreement for any penalties associated with paying off your loan ahead of schedule.

6. What documents do I need to apply for a loan?

Common documents required include:

- Proof of identity (e.g., passport or driver’s license)

- Proof of income (e.g., pay stubs or tax returns)

- Bank statements

- Details about existing debts

7. How is my monthly payment calculated?

Your monthly payment is calculated based on the loan amount, interest rate, and repayment term. The formula considers both principal and interest payments, and using a loan calculator can help you determine the exact amount.

8. What are origination fees?

Origination fees are upfront charges lenders may impose for processing a new loan application. They are typically a percentage of the total loan amount and can affect the overall cost of borrowing.

9. What should I consider before taking out a loan?

Before taking out a loan, consider:

- Your ability to repay the loan

- The total cost of borrowing (including interest and fees)

- The purpose of the loan and if it aligns with your financial goals

- Alternative financing options

10. Where can I apply for a loan?

Loans can be obtained from various sources, including:

- Banks

- Credit unions

- Online lenders

- Peer-to-peer lending platforms

11. What happens if I default on my loan?

Defaulting on a loan means failing to make required payments as agreed. This can lead to serious consequences such as damage to your credit score, legal action from the lender, and potential loss of collateral if the loan is secured.

12. Are there alternatives to traditional loans?

Yes, alternatives include:

- Credit cards (for smaller purchases)

- Personal lines of credit

- Peer-to-peer lending

- Home equity lines of credit (HELOCs)