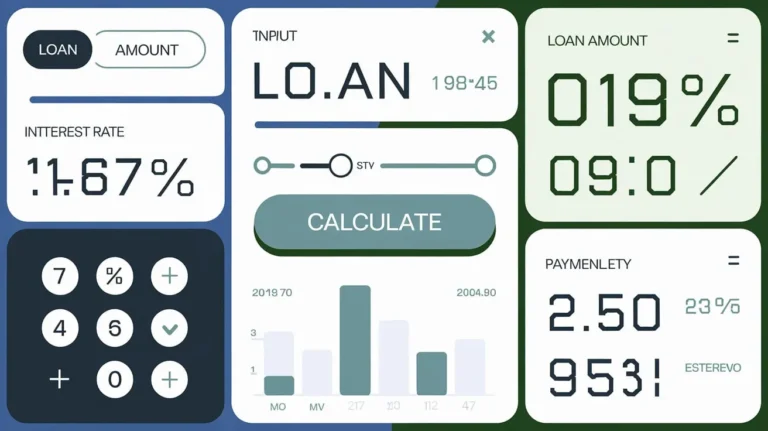

Note: Ensure that you select “Not Applicable” if you don’t have the value for any input so that the calculation can be completed.

KRA Tax Calculator

Key Values and Options for KRA PAYE Calculator

1. Tax Bands and Rates

PAYE calculator tax bands and rates are applicable for calculating PAYE:

| Taxable Income (Monthly) | Tax Rate (%) |

|---|---|

| Up to Ksh 24,000 | 10% |

| Ksh 24,001 – Ksh 32,333 | 25% |

| Above Ksh 32,333 | 30% |

2. Personal Relief

- Amount: Ksh 2,400 per month (Ksh 28,800 annually).

- This relief is deducted from the total tax payable.

3. Insurance Relief

- Maximum Relief: Ksh 60,000 per year.

- Tax relief of 15% on insurance premiums paid.

4. Disability Exemption

- Amount: Ksh 150,000 per month (Ksh 1,800,000 annually).

- This exemption reduces taxable income.

5. Affordable Housing Levy

- Rate: 1.5% of gross salary.

- This is calculated based on the employee’s gross salary.

6. Allowable Pension Fund Contribution

- Monthly Limit: Ksh 20,000.

- Annual Limit: Ksh 240,000.

- Contributions to registered pension schemes are deductible.

7. Allowable Mortgage Interest

- Monthly Limit: Ksh 25,000.

- Annual Limit: Ksh 300,000.

- Interest paid on loans for purchasing or improving residential premises is deductible.

8. NSSF (National Social Security Fund) Contribution

- For employees earning below Ksh 18,000:

- Default contribution: Ksh 200 per month.

- For employees earning above Ksh 18,000:

- Maximum contribution can be up to Ksh 2,160 per month.

9. NHIF (National Hospital Insurance Fund) Contribution

NHIF contributions vary based on salary tiers:

| Salary Range (Monthly) | NHIF Contribution (Ksh) |

|---|---|

| Up to Ksh 5,999 | 150 |

| Ksh 6,000 – Ksh 7,999 | 300 |

| Ksh 8,000 – Ksh 11,999 | 400 |

| Ksh 12,000 – Ksh 14,999 | 500 |

| Ksh 15,000 – Ksh 19,999 | 600 |

| Ksh 20,000 – Ksh 24,999 | 750 |

| Ksh 25,000 – Ksh 29,999 | 800 |

| Above Ksh 30,000 | Varies based on tiers |

Summary Of What You Should Know

In This tax calculator We:

- Ensure that all deductions and contributions are dynamically calculated based on the user’s gross salary.

- Use the appropriate tax rates based on the defined bands.

- Allow users to input values for deductions where applicable but default to government-provided values if they leave fields blank.

- Include all necessary calculations for net pay after applying these deductions and contributions.

| Item | Monthly Limit (Ksh) | Annual Limit (Ksh) | Effective Date |

|---|---|---|---|

| Personal Relief | 2,400 | 28,800 | 25th April 2020 |

| Insurance Relief | 5,000 | 60,000 | 1st January 2007 |

| Disability Exemption | 150,000 | 1,800,000 | 10th March 2010 |

| Affordable Housing Relief | 9,000 | 108,000 | 1st July 2018 |

| Allowable Pension Fund Contribution | 20,000 | 240,000 | 1st January 2006 |

| Allowable Mortgage Interest | 25,000 | 300,000 | 1st January 2017 |

| Tax Bands and Rates | |||

| Up to Ksh 24,000 | Up to Ksh 288,000 | 10% | |

| Ksh 24,001 – Ksh 32,333 | Ksh 288,001 – Ksh 388,000 | 25% | |

| Ksh 32,334 – Ksh 500,000 | Ksh 388,001 – Ksh 6,000,000 | 30% | |

| Ksh 500,001 – Ksh 800,000 | Ksh 6,000,001 – Ksh 9,600,000 | 32.5% | |

| Above Ksh 800,000 | Above Ksh 9,600,000 | 35% |

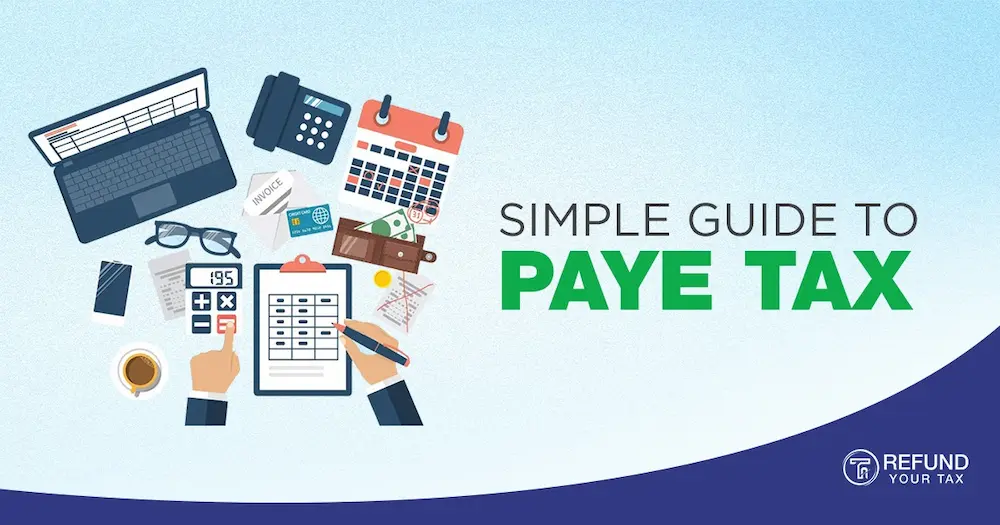

SHIF Will Replace NHIF Starting October 2024

It’s important for both employers and employees in Kenya to understand how the PAYE (Pay As You Earn) system works, especially with the upcoming switch from NHIF to the Social Health Insurance Fund (SHIF) on October 1, 2024. This guide helps you grasp the basics of PAYE, including taxable income, deductions, and how to file your taxes. We’ll also look at the updated PAYE Calculator Kenya, which now includes SHIF deductions.

What is PAYE?

PAYE is a system where employers take income tax directly from employees’ salaries and send it to the Kenya Revenue Authority (KRA). This helps the government get steady tax income and ensures that employees stay compliant throughout the year.

To figure out your tax deductions, the updated PAYE Calculator Kenya makes it easier by breaking down your monthly or yearly taxable income, including the new SHIF deductions. Calculate with kra webstite instead.

Taxable Employment Income in Kenya

When calculating your PAYE, here’s what counts as taxable income:

- Cash Payments: This covers all salary elements like wages, bonuses, allowances, commissions, and overtime.

- Non-Cash Benefits: Any benefits over Ksh 3,000 per month (like company cars, housing, or low-interest loans) are taxable.

- Mileage Reimbursement: If your reimbursement exceeds the AA Kenya rates for work-related travel, it’s taxable.

- Club Fees: Membership fees paid by your employer are taxable if considered a business expense.

- Applies to All Employees: Whether you’re a resident or non-resident earning in Kenya, you fall under PAYE.

Using the updated PAYE Calculator Kenya will help you accurately calculate taxes, including the new SHIF contributions.

Employer Responsibilities for PAYE in Kenya

Employers need to follow PAYE rules, especially with SHIF coming in:

- PAYE Registration: Employers must register if they are paying salaries or benefits.

- Tax Withholding: Use the current PAYE tax tables to deduct the right amount.

- Tax Remittance: Send the deducted taxes to the KRA by the 9th of the following month.

- PAYE Return Filing: Employers must file returns that show tax deductions from employees.

With SHIF replacing NHIF, employers should update their systems. The PAYE Calculator Kenya is now updated to include SHIF deductions for easier compliance.

PAYE Calculation: Taxable Income and Deductions

Your PAYE calculation is based on your total salary minus certain deductions:

- Gross Salary: This is your total pay before any deductions.

- Non-Taxable Benefits: Subtract the value of any benefits that aren’t taxable.

- Tax Brackets: Kenya has different tax rates ranging from 10% to 35% as of July 2023.

- Allowable Deductions: These can lower your taxable income, including:

- Mortgage Interest: Up to Ksh 300,000 per year for your main home.

- Pension Contributions: Up to Ksh 20,000 per month.

The updated PAYE Calculator Kenya helps apply the right tax rates and deductions, including SHIF contributions.

SHIF Replacing NHIF

Starting October 1, 2024, the Social Health Insurance Fund (SHIF) will take the place of the National Hospital Insurance Fund (NHIF). Contributions to SHIF will be 2.75% of your gross salary, with a minimum payment of KES 300 per month and no upper limit. Employers must submit these contributions by the 9th of the following month, along with PAYE.

The updated PAYE Calculator Kenya now includes SHIF contributions to help everyone stay compliant with the new health insurance rules.

Tax Reliefs in Kenya

Employees can benefit from various tax reliefs, including:

- Personal Relief: Currently set at Ksh 2,400 per month for residents.

- Other Reliefs: These can include reliefs for insurance premiums and contributions to post-retirement medical funds.

Affordable Housing Levy

Both employers and employees will contribute 1.5% of the gross monthly salary to the Affordable Housing Levy. This contribution is included in the updated PAYE Calculator Kenya, making it easier to calculate your total deductions.

PAYE Filing Process in Kenya

To file your PAYE:

- Gather Employee Data: Compile all necessary information about your employees.

- Submit via iTax: Log in to the iTax system to file your PAYE return. This includes submitting even if there’s no tax to report (a nil return).

The updated PAYE Calculator Kenya can help you collect the correct information for your return, including SHIF contributions.

PAYE Penalties for Non-Compliance

If you don’t comply with PAYE rules, you may face penalties:

- Late Filing: A penalty of 25% of the tax owed or Ksh 10,000, whichever is higher.

- Late Payment: You’ll incur 5% of the tax owed plus 1% interest for each month it’s late.

- Failure to Deduct and Remit: This results in a penalty of 25% of the tax owed or Ksh 10,000, whichever is higher.

See also our pregnancy conception calculator and menstrual period calculator